If you're running a business in the UAE, understanding whether you need an audit can be confusing — especially with all the different rules across mainland, free zones, and other areas.

Here’s a simple breakdown to help you figure it out.

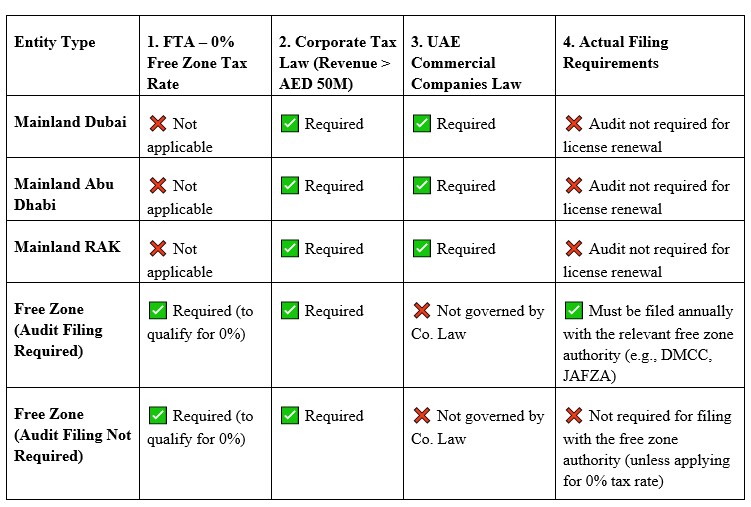

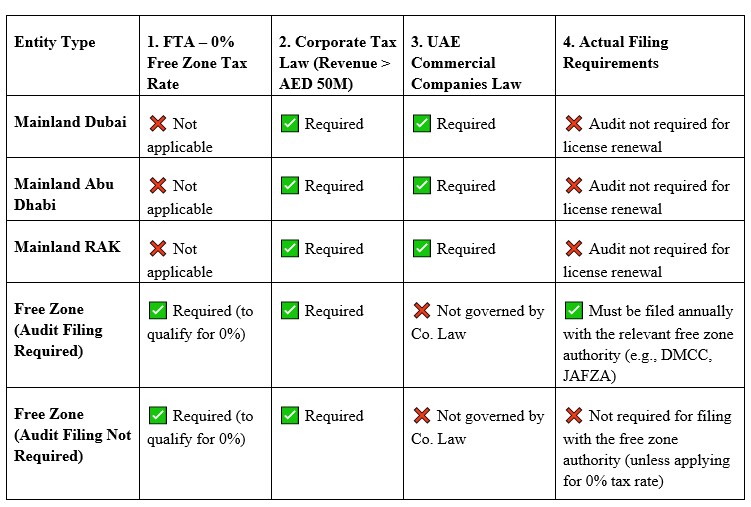

✅ Audit Requirements at a Glance

📌 Bottom Line:

- Most companies in the UAE need to prepare audited financial statements annually, even if they don’t need to submit them to the relevant authority.

Mainland companies (especially LLCs and joint-stock companies) must comply with audit requirements under the UAE Commercial Companies Law.

Free zone companies need to be aware of whether they are filing audited accounts with their free zone authority — particularly if they want to qualify for the 0% corporate tax rate.

Need help with your audit or unsure about your filing obligations?

Get in touch with

us — we’ll make sure you’re fully compliant, with no hassle.