In the United Arab Emirates (UAE), a taxable person refers to any individual or entity that is either already registered or mandated to register for Tax purposes under the Decree-Law. Broadly speaking, taxable persons encompass various entities, including corporations, partnerships, sole proprietorships, associations, as well as certain individuals like freelancers or self-employed professionals, provided their taxable transactions exceed the mandatory registration threshold.

Becoming a taxable person is simpler than you think. Follow along as we guide you through the steps, from logging into the EmaraTax Portal to creating your profile.

Begin by visiting the website. You can do this by clicking on the following URL: www.eservices.tax.gov.ae

To register, sign in to the portal using your email, password, and assigned security code for your existing eServices account.

If you haven't created an account yet, please refer to our detailed guide available here.

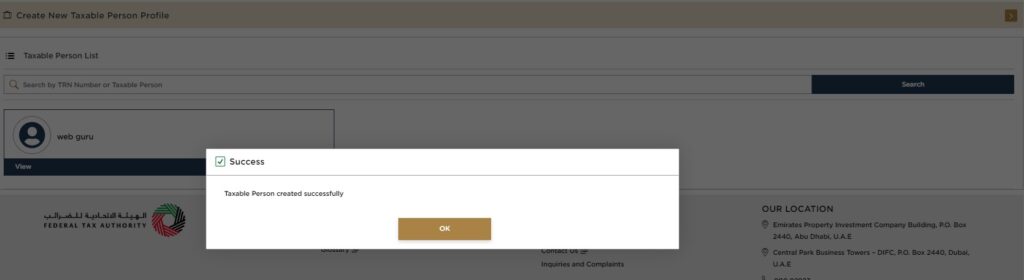

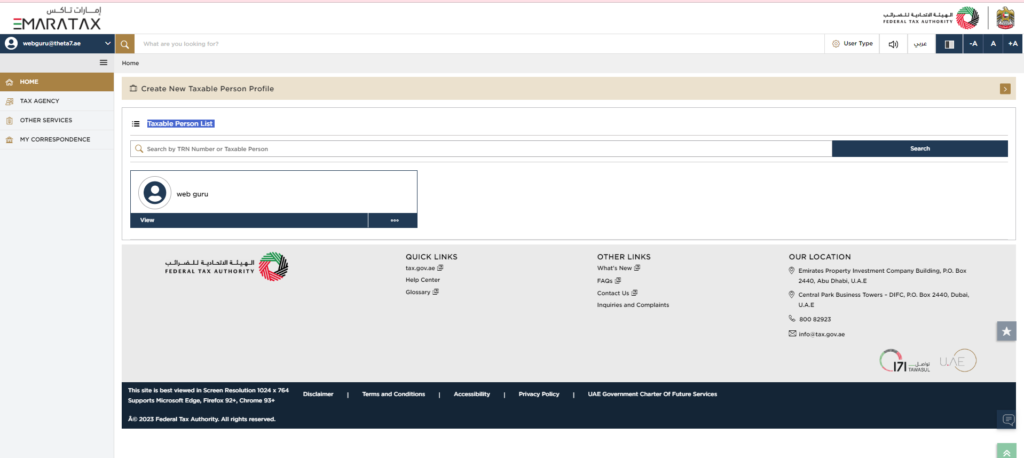

After logging in, you will automatically be redirected to your user dashboard. This will display profiles of taxable persons linked to your account under the "Taxable Person List."

Since you are registering a new entity, your list will be empty as you'll be creating a New Taxable Person Profile.

To get started, click on the top-most option labelled "Create New Taxable Person Profile."

Once all required fields are filled out, click on 'Create' and your taxable person entity will appear in your profile list indicating successful registration!

Please see this https://youtu.be/G1Y7eWgtDao?si=b70IUMwvHxnS06jO for an in-depth video tutorial guide on how to create a new taxable person profile.

For more expert guidance on UAE tax matters, please be sure to reach out to us.