How Theta7 Simplifies the Journey for Global Entrepreneurs

The United Arab Emirates (UAE) is more than just Dubai. It’s a federation of seven emirates—Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al Quwain, Ras Al Khaimah, and Fujairah—each offering unique advantages to entrepreneurs. From zero income tax and world-class infrastructure to digital-first company setups and residency options, the UAE has positioned itself as a top destination for global business pioneers.

At Theta7, we specialize in making this journey seamless and friction-free, regardless of which emirate you choose. This guide walks you through the exact steps to launch your business and secure residency—remotely, quickly, and effectively.

When selecting a free zone in the UAE, it’s essential to align your business needs with the strengths of each location. Here’s a breakdown of the most strategic free zones across the Emirates:

KIZAD stands out as a powerhouse for logistics, manufacturing, and heavy industries, thanks to its direct access to Khalifa Port. Its robust infrastructure and connectivity make it a top choice for businesses that rely on efficient global shipping and large-scale industrial operations.

Dubai offers world-class free zones like DMCC, ideal for tech startups, global trading firms, fintech companies, and consultants. Its fully digital setup process ensures seamless business registration and management. Meydan Free Zone also caters to similar sectors, providing flexible licensing and a prime location with strong connectivity.

SHAMS is tailored for media professionals, creatives, and freelancers, delivering cost-effective packages and an innovation-driven environment. It’s a smart choice for entrepreneurs in content creation, digital marketing, and design fields.

RAKEZ is recognized for being affordable and highly adaptable, offering customized solutions for SMEs and a wide range of industries. It combines cost-efficiency with excellent business support, making it a go-to zone for startups and growing businesses.

Strategically located near the Port of Fujairah, this free zone is a hub for maritime services, import/export operations, and businesses targeting East Africa and India. It offers streamlined logistics and competitive trade advantages for businesses looking to expand into key international markets.

A well-organized entrepreneur can expect to complete everything within 2–3 weeks, depending on:

Emirate and chosen free zone

Visa processing speed

Business activity complexity

Multi-currency accounts

Fast personal and business account setup

24/7 support and an intuitive app

Mashreq NeoBiz (Dubai/Abu Dhabi)

RAKBANK (RAK)

Emirates NBD

Before arriving in Dubai, ensure you have the following prepared:

This stage takes up to one month but can be faster.

Upon arrival, follow these steps to expedite the process:

If well organized, you can complete this in 2 weeks.

Once everything is completed:

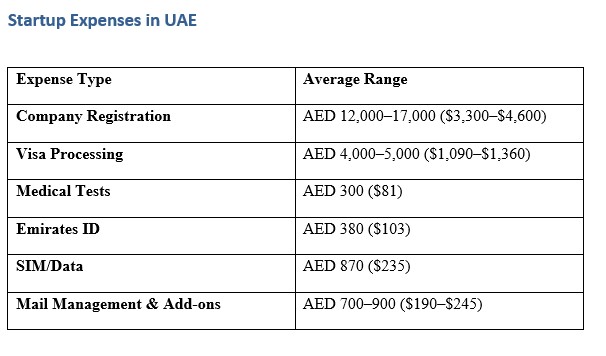

Prices vary based on emirate and business activity.

Abu Dhabi: Al Maryah Island (business center) or Al Reem Island (modern, residential)

Dubai: Business Bay, Downtown, or JLT (entrepreneur hubs)

Sharjah: Al Majaz or Al Khan (affordable with quick access to Dubai)

RAK & Fujairah: Near Free Zone HQs or Corniche areas for balance of business and leisure

Q: Can I operate a UAE business from abroad?

Yes, many Free Zones offer 100% remote setup and virtual licenses.

Q: Which emirate is cheapest for setting up a business?

Ras Al Khaimah and Sharjah generally have the lowest startup costs.

Q: Do I need to be in the UAE to open a bank account?

Yes, physical presence is required during the ID and biometric process.

Q: Can Theta7 assist with multiple emirates?

Absolutely. We help entrepreneurs launch across all Free Zones in the UAE.

Setting up a business and securing your residency across the UAE is no longer complex or costly—if you have the right partner. Theta7 offers end-to-end support to help you register, bank, and establish yourself in any emirate—from Abu Dhabi to Fujairah.

Ready to Launch Your UAE Business the Right Way?

Join thousands of entrepreneurs worldwide who have successfully launched their ventures with Theta7. Whether you're targeting Dubai’s dynamic tech scene, Abu Dhabi’s industrial hubs, or Sharjah’s creative zones, we’ve got you covered.

➡️ Sign up today with Theta7 to simplify your company setup, secure your residency, and start operating—all without ever needing to leave your home country.

🔐 Fast. Digital. Compliant.

👉 Get Started with Theta7 Now!