The United Arab Emirates (UAE) implemented Value Added Tax (VAT) in 2018. Businesses that meet specific criteria are required or entitled to register for VAT. This article provides a comprehensive guide on the VAT registration process in the UAE.

Here's a step-by-step guide on how to register for VAT in your eServices Account:

Go to the official EmaraTax website: www.eservices.tax.gov.ae and proceed to log in using your credentials.

These credentials typically include a username and password. Alternatively, you can use UAE Pass for authentication if you have it set up.

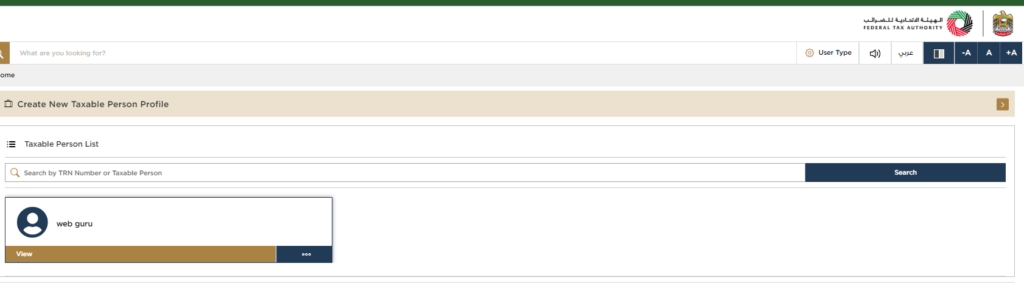

Selecting an Existing Entity: If you’re dealing with an entity that is already registered with the FTA, you can select it from your list of taxable persons. Click ‘View’ to open the Taxable Person Dashboard.

Clicking "view" on the taxable person profile redirects you to their dedicated dashboard within the FTA e-Services system. This dashboard serves as a central hub for managing various aspects related to the taxable person's VAT compliance. Spot the 'Registration Overview Section.

From this dashboard, locate the VAT section under the 'Registration Overview' and select 'Register' on the VAT tile.

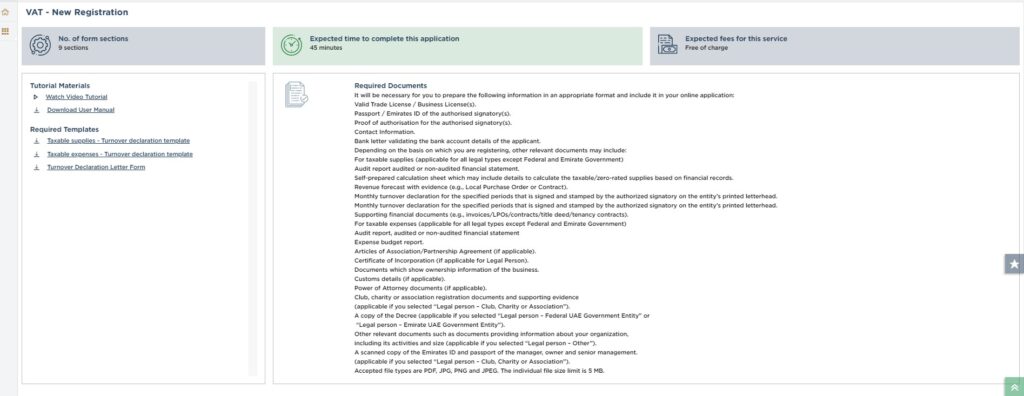

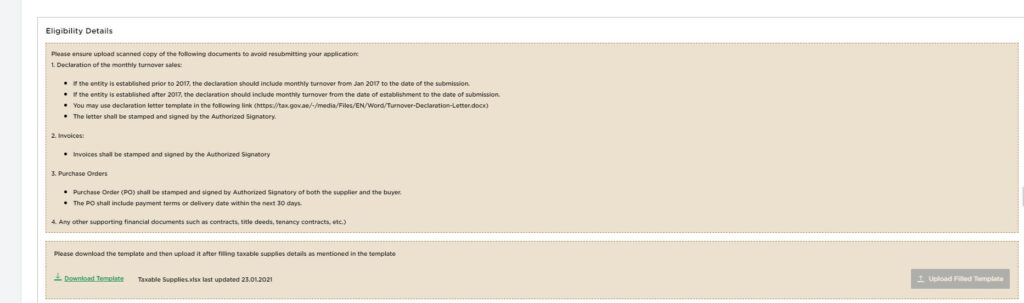

This page serves as a crucial resource to help you navigate the registration smoothly and avoid any potential delays or errors. It typically aims to simplify the VAT registration process by providing clear and concise information on eligibility, documentation, application procedures, and timelines, all aligned with the regulations and requirements set forth by the FTA.

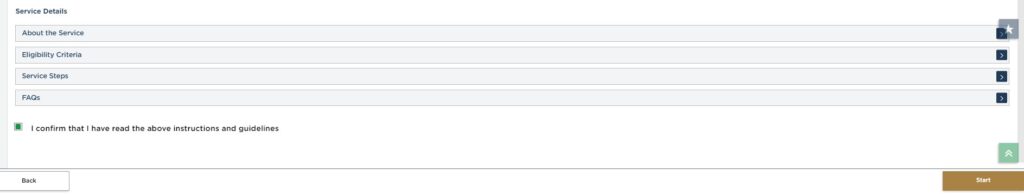

You must read and confirm that you understand these details by checking the box.

Then click on Start’ to begin the application process smoothly.

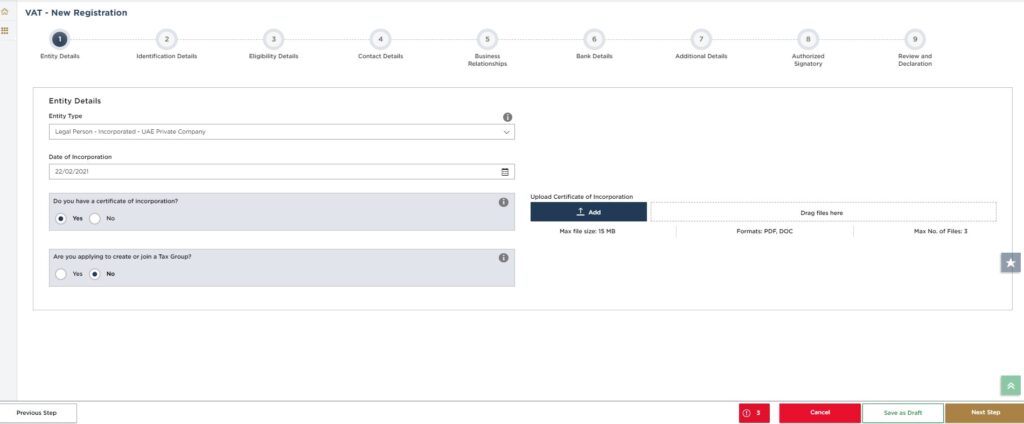

This online form is divided into 9 major sections with a progress bar. The current section is highlighted in blue as the completed sections are highlighted in green. To advance sections, all mandatory (*) current fields must be completed correctly. Non-mandatory fields are marked as ‘Optional’.

To ensure seamless progress during this application progress: Click the designated 'Save as Draft" button to avoid losing your information and repeating the steps. Remember, the system automatically logs you out after a period of inactivity exceeding 10 minutes.

Please see these sections outlined below:

Enter the details of the business to be registered including:

What is a Tax Group?

A Tax Group allows multiple legally independent businesses under the same control to be treated as a single entity for VAT purposes. This simplifies VAT compliance and reporting for the group.

Related parties could include subsidiaries, parent companies, joint ventures, or individuals with significant control over your business.

(A) Identification Details

- Enter your Main Trade License details, including the license number, issuing authority, license issue date, trade license expiry date, Legal Name in English & Arabic, as well as the Trade Name in English &Arabic

- Upload a scanned copy of your Trade License/Business License: Ensure the document is in PDF, DOC, or DOCX format and under 15MB.

B) Business Activities

- Briefly describe your primary business activities –

- Main Industry: The broad category your business falls under (e.g., Retail Trade)

- Main Group: A more specific category within the industry (e.g., Food Retail)

- Sub-Group: Further narrows down your activity (e.g., Grocery Stores)

- Activity: The specific activity your business performs (e.g., Sale of Groceries)

- Activity Code: A unique code assigned to your specific activity by the FTA

- Ownership: Indicate whether any owner holds more than 25% ownership by selecting "Yes" or "No."

- Branch Details: If applicable, provide details for any branches your business operates within the UAE.

- Sole Establishment Details - In case you have a Sole Establishment

- Property Details - Do you own any property?

This section determines your obligation to register for VAT.

The image below shows the instructions for the taxable persons who fall under mandatory registration of VAT in the UAE:

This screenshot below shows the details that are required to be gathered for those whose eligibility criteria is 'Voluntary' Registration:

- Provide Business Contact Information including: Country, Building name & number, Street, Area, City, preferred contact information (Mandatory – Mobile and landline number as well email.) and Emirate.

- (P.O Box) - is optional

- Additionally, please see this informative notes to adhere to in this section:

Only relevant if your business belongs to a VAT Group. Provide details of other group members, including their legal names, tax registration numbers, and contact information.

Enter your company's bank account details, including account holder's Name, account number, IBAN, bank name, and branch details as well as your resident country.

Additionally upload a scanned copy of a 'Bank Validation Letter'

This section might be used for additional information specific to your business or as per FTA requirements. Refer to this image below:

- Designate an authorized representative with their contact details: First and Last Name in English & Arabic, Mobile number & Email ID

- Upload scanned copies of their Emirates ID and passport (if applicable)

Review Information: Before finalizing the registration process, take the time to review all the information you’ve provided for accuracy and completeness. Make any necessary corrections or additions before proceeding.

Carefully review all the information you've provided for accuracy and completeness. Make any necessary corrections before submitting the application.

Confirmation: Once you’re satisfied with the information provided, check the declaration box at the bottom go on and submit the application through the EmaraTax portal

Congratulations! Once the FTA approves your VAT registration application, you will receive confirmation through your e-Service account. Here's what happens next:

You will receive an official VAT registration certificate with your unique Tax registration number (TRN).

This TRN is crucial for issuing VAT invoices, claiming input tax credits, and interacting with the FTA.

Integrate your accounting system to handle VAT calculations and record keeping.

This includes recording VAT on sales and purchases, separating taxable and non-taxable transactions, and generating VAT reports.

All taxable supplies made after your effective registration date must include your VRN and the applicable VAT rate.

Ensure your invoices comply with the FTA's invoicing requirements.

You are obligated to file periodic VAT returns with the FTA, typically every three months.

These returns report your taxable supplies, input tax, and any payable or refundable VAT.

Familiarize yourself with the UAE's VAT regulations and keep updated on any changes.

Maintain proper records of your VAT transactions for potential audits by the FTA.

Remember, receiving your VAT registration is just the beginning of your VAT compliance journey. Staying informed, maintaining accurate records, and filing timely returns are crucial for avoiding penalties and ensuring smooth business operations.

You can access the FTA website for VAT guides, training materials, and other resources to help you understand your obligations.

Consider seeking professional assistance from a tax advisor to ensure compliance and navigate complex VAT scenarios.