While the FTA oversees taxes, the EmaraTax portal is the digital administration system used to deliver FTA's tax services and enable taxpayers to comply with their obligations online.

If you already have an account with the FTA, your existing FTA account login details will have automatically been transferred to EmaraTax.

Your only task? Simply reset your password when logging in for the first time.

Logging to the FTA

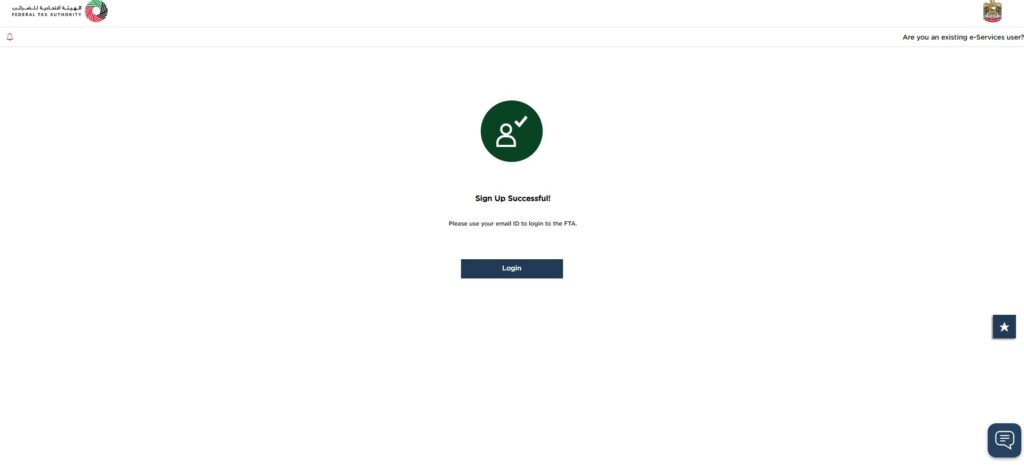

After Sign-up successful, you'll be directed to the FTA-Emaratax portal for your first login.

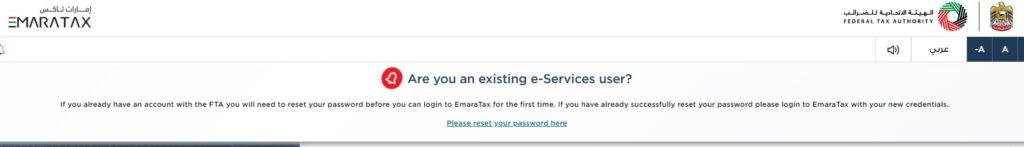

Visit the portal:

Go to: www.eservices.tax.gov.ae Once there, locate the "Are you an existing eServices user?" section at the top of the page.

Password Reset Process:

Under this section, click on the link labelled "Please reset your password here." This action will initiate the password reset process, ensuring a secure login experience.

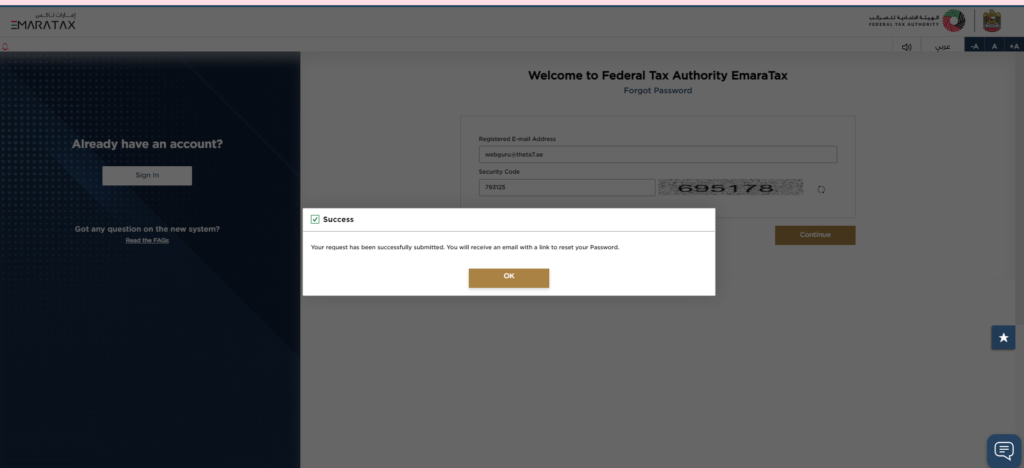

Resetting Your Password via Email

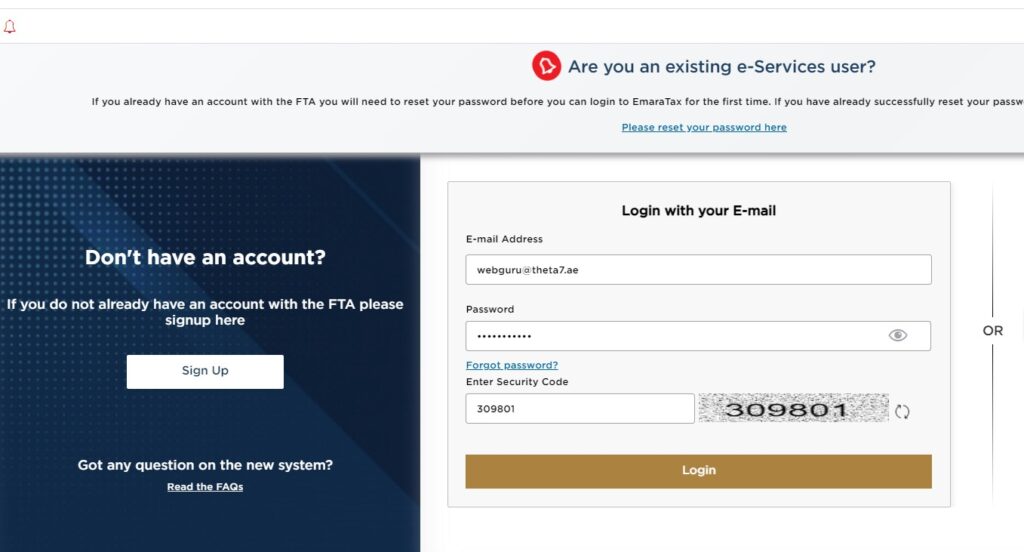

If you have access to the email address registered with your FTA account, enter it along with the provided security code. Click "Continue" to proceed.

A new temporary password and activation link will be sent to your registered email.

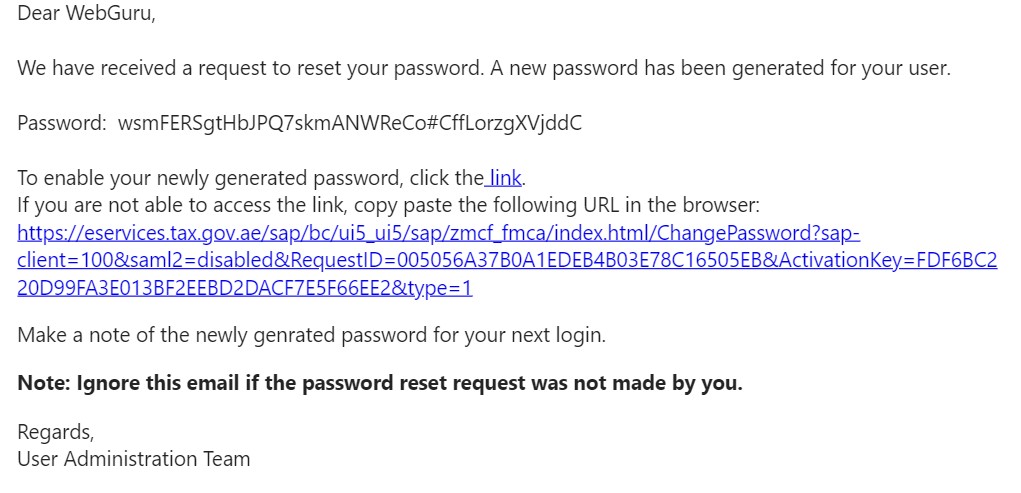

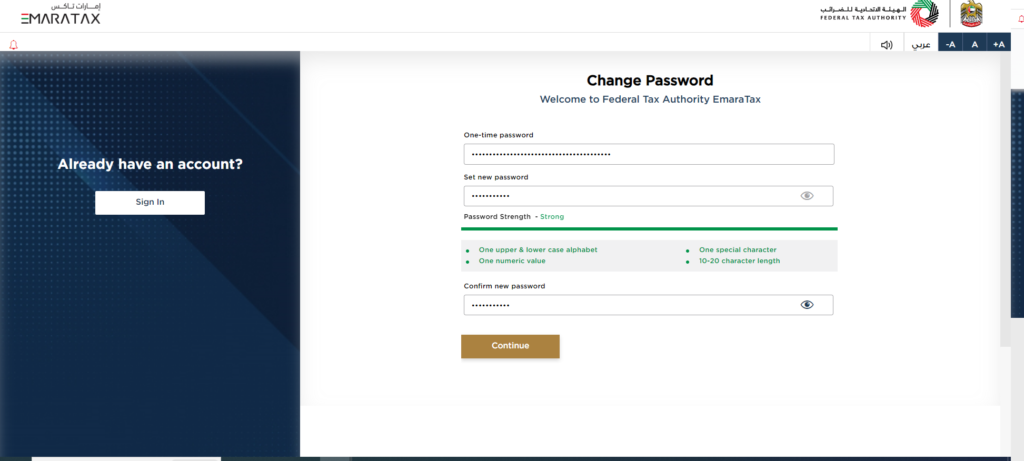

Click on the activation link to open the EmaraTax portal using the temporary password. Once logged in, create a new password according to the specified requirements.

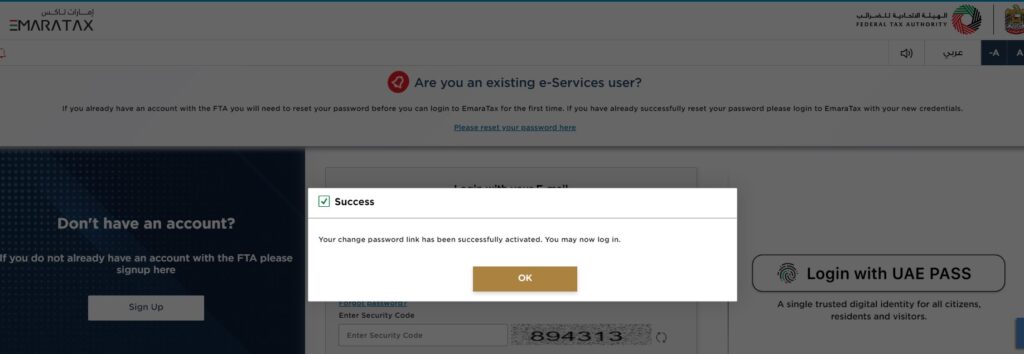

Once the password link has been successfully activated, you may now go ahead and login using the temporary long one-time password.

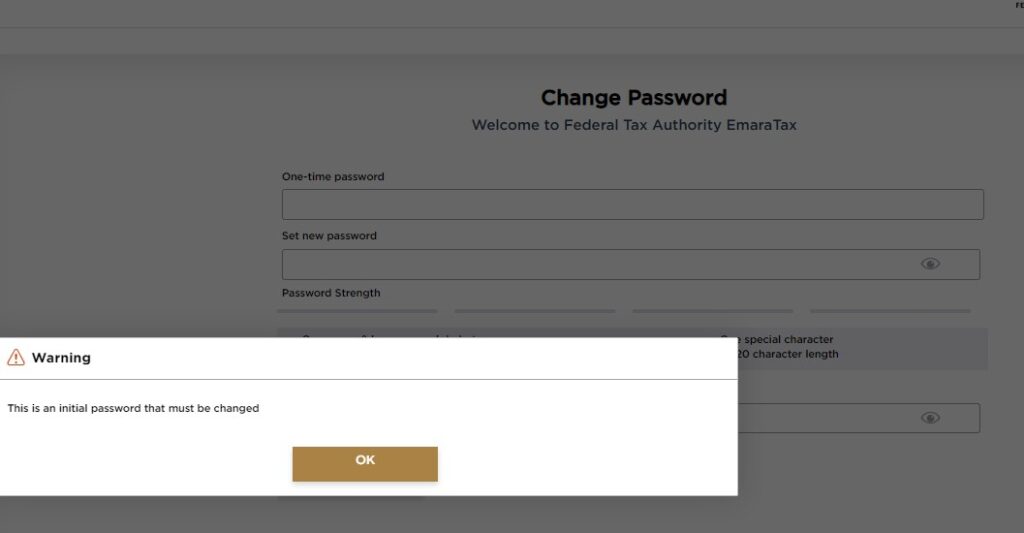

Changing the initial password.

Key in the OTP, then set a new password, confirm it then select continue. Please ensure it's a strong password.

You can now officially login after the resetting of the password process.

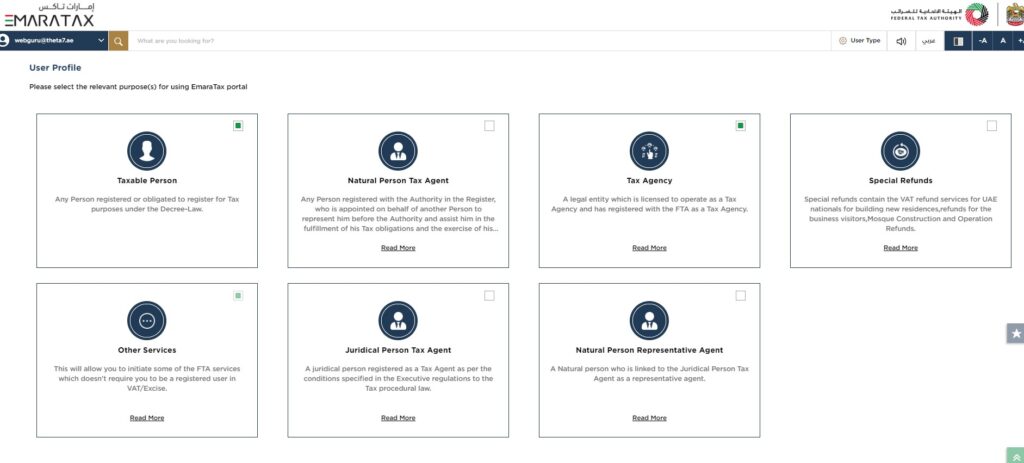

Once you've now successfully logged in, go ahead and select the relevant purpose for using the EmaraTax portal from the given choices under "User Profile"

- Alternative Password Reset Method

If you are unable to access your registered email, select the option "Change Email Address" to initiate the password reset process through an alternative method.

For more information and a complete guide on how to reset your password - please see here.

By following these steps, you can successfully log into the EmaraTax Portal for the first time and begin managing your tax affairs efficiently.

"We're here to help! Contact us for personalized support."