In the dynamic financial landscape of the UAE, businesses require efficient tools to manage complex transactions, VAT regulations, and multi-currency dealings. Odoo, a comprehensive open-source ERP system, offers robust features to streamline financial operations. This guide provides UAE businesses with a detailed walkthrough on integrating, managing, and reconciling bank feeds within Odoo.

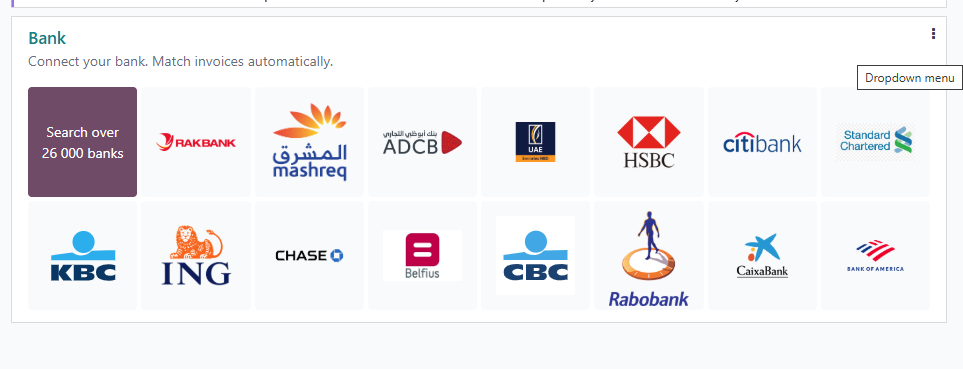

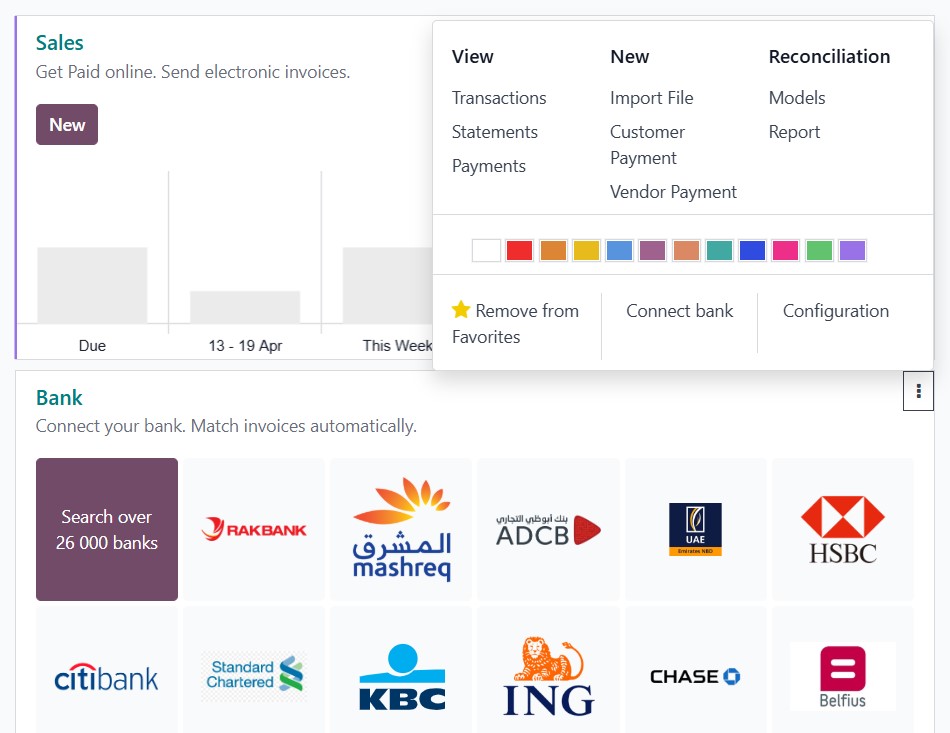

To find out if your UAE bank offers real-time syncing with Odoo:

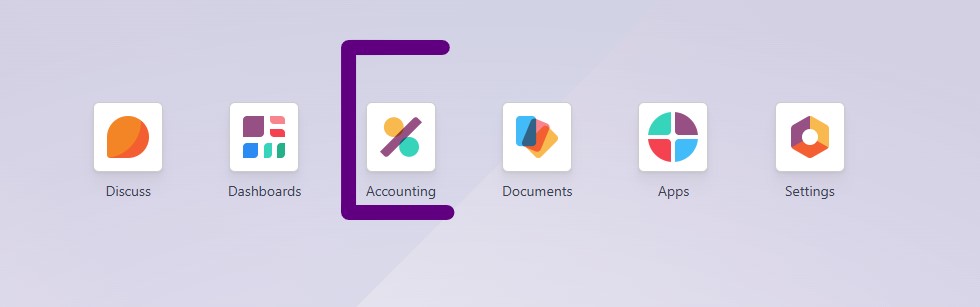

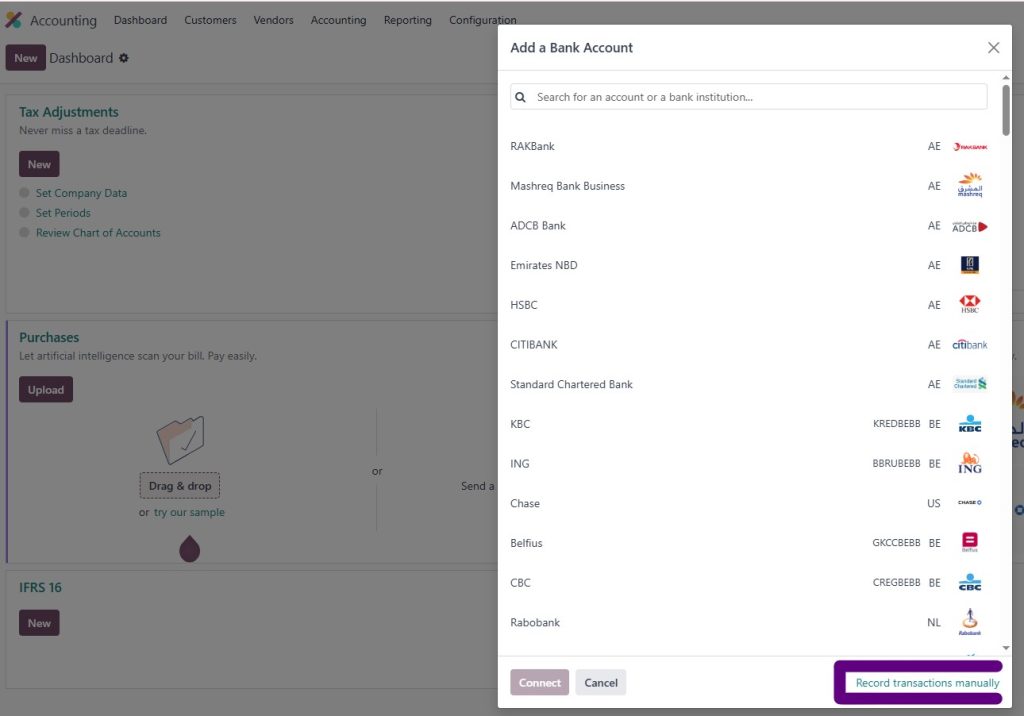

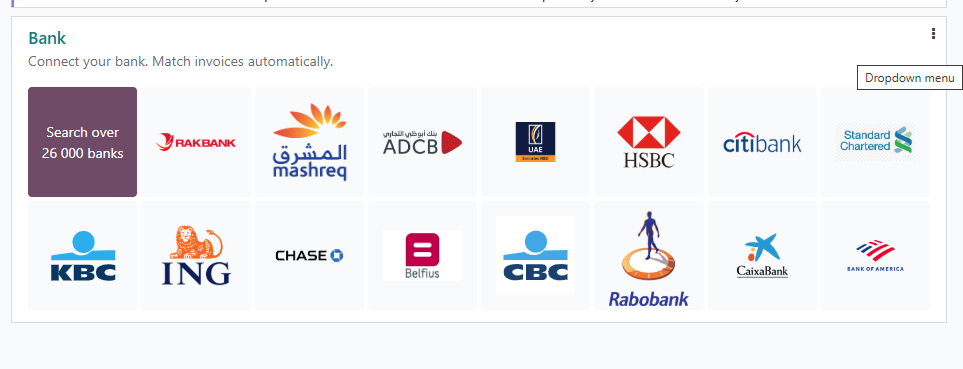

Open your Accounting dashboard and scroll to the Bank section.

Click the three-dot icon (⋮) on any bank tile and choose Connect Bank.

A search-enabled pop-up window will appear—type in your bank’s name.

If it appears in the list:

Hit Connect, log in securely with your bank credentials.

If your bank is not listed, you can still manage your transactions by importing statements manually.

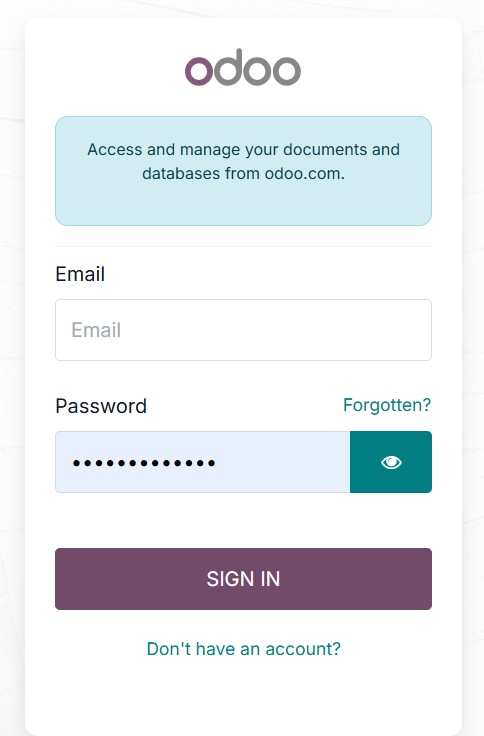

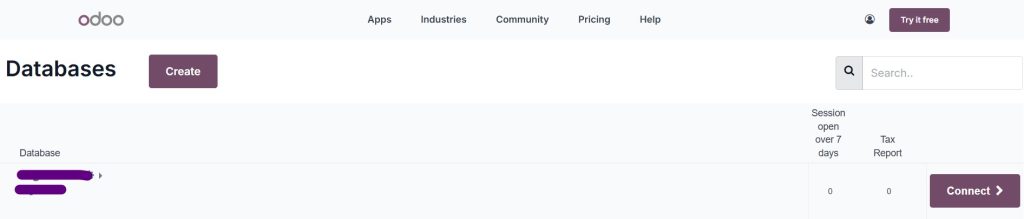

Once you're logged in and on the Databases page, locate your company and click Connect.

To connect your bank for automatic transaction syncing:

- Click Connect, then follow the prompts to securely log in with your bank credentials.

- Authorise access and complete any two-factor authentication your bank may require.

✅ Once connected, your bank account will begin syncing transactions automatically with Odoo.

If your bank isn’t listed:

- Bank Name

- Account Number

- Bank Identifier Code (IBAN, SWIFT, or Local)

Click Create to add the bank account.

After setup, use the Import File option to upload your bank statements. Supported formats include CSV, QIF, OFX, and CAMT.

After successfully adding your bank account:

Head to the Bank section in your Accounting dashboard.

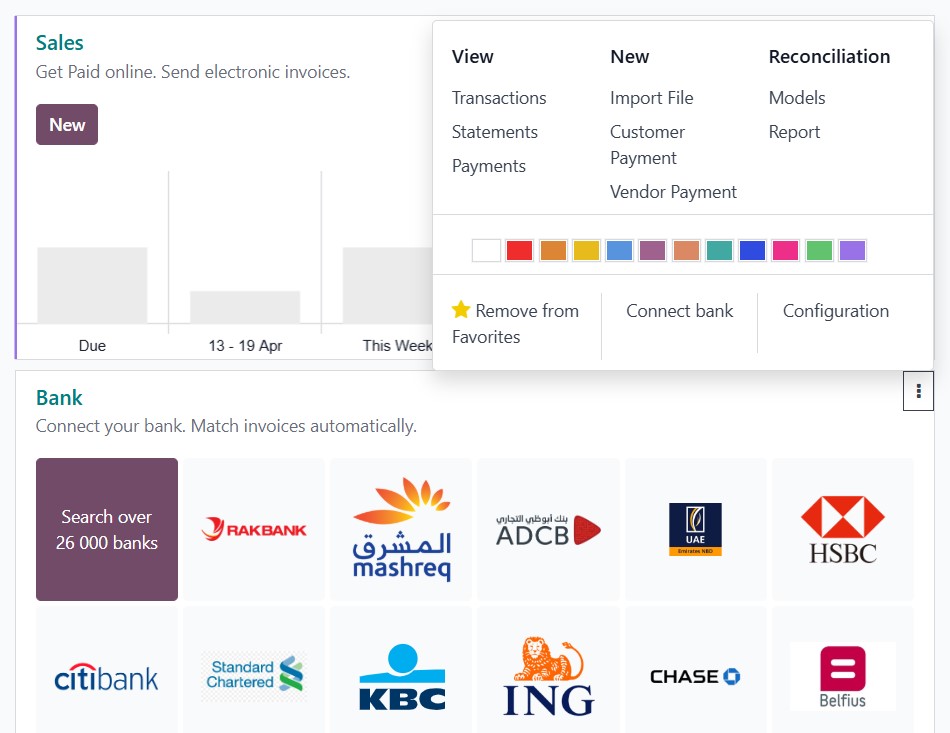

Click the three-dot menu (⋮) on the bank tile to access a suite of banking tools designed to streamline your financial workflows:

Reconcile

Easily match imported transactions with existing invoices or bills to maintain clean and accurate records.

New Statement

Manually generate a bank statement when you need to document specific transactions or periods not covered by imports.

Import File

Upload statement files in supported formats—CSV, QIF, OFX, CAMT—to bring in your bank data manually.

View Statements

Quickly review historical statements linked to the selected bank account, ensuring easy access to past financial records.

Configuration

Edit and update journal settings related to your bank account, such as default accounts and transaction behaviors.

Connect Bank

Reconnect your bank or switch to a different sync provider if your current integration changes.

These tools offer centralized control, helping you manage all bank-related tasks from one convenient interface.

Whether you're setting up a new bank journal or editing an existing one:

Go to Accounting > Configuration > Journals, then select the journal tied to your bank account.

In the Bank Feed Type section, you’ll define how transactions are handled:

Undefined Yet

Use this if you haven’t decided on an integration method or if the setup is still pending.

Import

Choose this if you intend to manually upload bank statement files regularly using formats like CSV or OFX.

Automated Bank Synchronization

Select this when you’re connecting to a supported bank to allow automatic transaction syncing in real-time.

Proper configuration ensures that transactions are processed correctly, avoids duplication, and keeps your financial data accurate and audit-ready.

Odoo automatically uses temporary accounts to manage transactions that haven’t yet been matched:

Temporarily holds unmatched entries until reconciliation is completed.

Used when a payment is received or made but hasn't yet been matched to a bank line.

Navigate to:

Accounting > Configuration > Journals > [Your Bank Journal]

Assign these accounts correctly to avoid reporting errors and maintain accurate financials.

Running an international business? Odoo makes handling foreign currencies effortless:

Enable Multi-Currency via:

Settings > Accounting

Assign Currencies per journal if they differ from your base currency (e.g., AED).

Odoo fetches daily exchange rates or allows you to input them manually.

Ideal for businesses dealing in USD, EUR, GBP, and other major currencies, ensuring smooth and accurate conversions.

Keep your finances clean and compliant with these smart practices:

Reconcile Regularly: Weekly or bi-weekly reconciliations prevent data backlogs.

Maintain Consistency: Use consistent names for vendors and customers to speed up matching.

Review Key Accounts: Frequently monitor suspense and outstanding accounts for unreconciled balances.

Stay VAT Compliant: Leverage Odoo’s built-in VAT reports tailored for UAE tax regulations.

Upgrade Your Financial Workflow with Theta7

At Theta7, we empower UAE businesses to simplify and streamline their accounting processes using Odoo’s full potential. Whether it's automating reconciliation or ensuring VAT compliance, our solutions are tailored to meet local financial regulations and global business needs.

What We Offer:

📞 Call or WhatsApp us now: +971 50 609 8543

🌐 Ready to get started? Visit: https://theta7.ae/contact/

📅 Schedule your FREE accounting consultation today and elevate your financial operations!