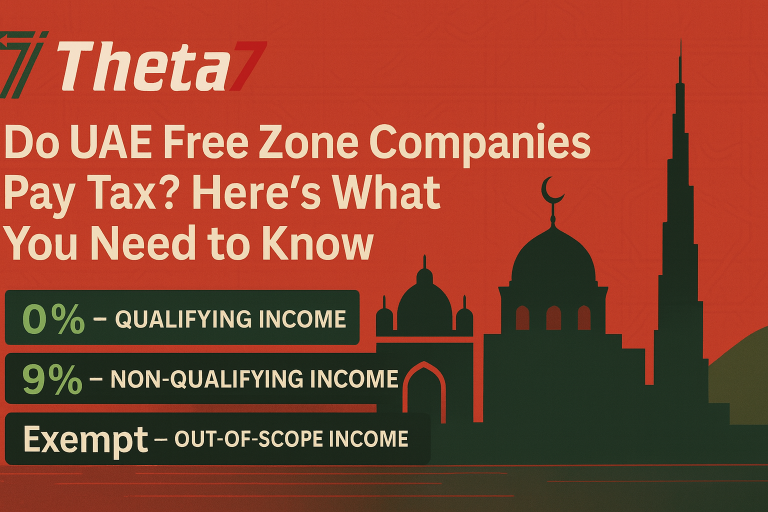

It is important to note that Free Zone companies are not exempt from corporation tax in the UAE, but they may qualify for a 0% tax rate. This is an important distinction as all Free Zone companies may be required to register for corporation tax with the Federal Tax Authority (FTA) and file returns at least annually.

To qualify for this 0% tax rate, the relevant income received by the Free Zone business must be qualifying Free Zone income and as a result of business with the UAE mainland is restricted.

It is important to ensure that you keen a clear separate within your bookkeeping records of the expenses that relate to each type of income.

As licensed accountants and tax advisers based in Dubai, we would be happy to support you and your business as you unlock your financial potential with our customized solutions. So don't wait any longer - reach out to us today and experience the difference that our team can make. We look forward to hearing from you!