Let Spondoo prepare your accounting returns and submit them to:

Our Year End Accountancy and Corporate Tax Services are available to organisations of all sizes. However, if you choose a monthly Theta 7 package, this service comes at a reduced rate, as we ensure your records are up-to-date and complete throughout the year.

During your application process you can choose to add business insurance, including employer liability insurance, public liability, professional indemnity, and more.

Whilst we are licensed accountants, this function is provided by our partners that are license insurance professionals under the UAE Insurance Authority (IA).

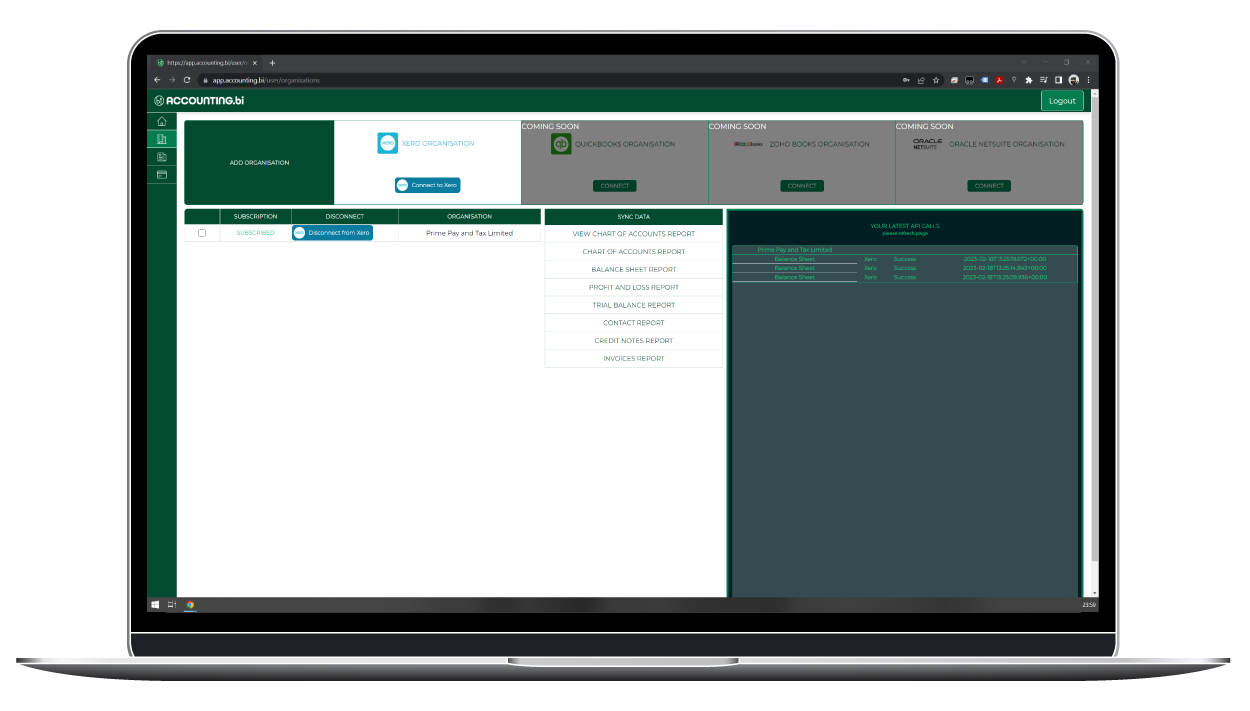

To keep your records up to date you need to keep your books in order. This involves our bookkeepers recording your day-to-day accounting transactions in your chosen accounting software. We work with Xero, Zoho Books, QuickBooks, Sage, Tally, SAP and NetStuite.

- Dedicated bookkeeping account manager

- Over 160 currencies available

- Online video calls - Scalable support levels

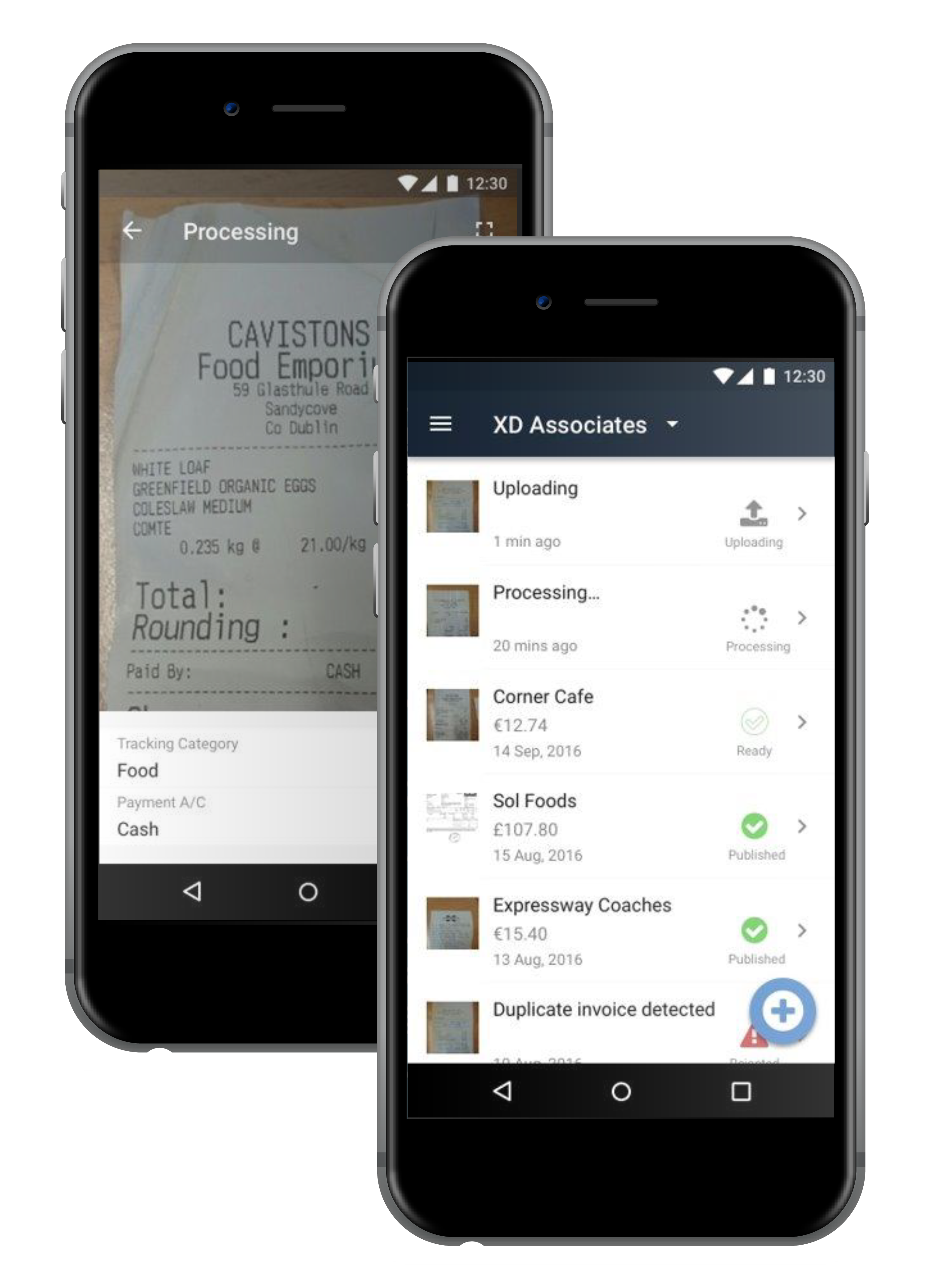

- Recommended app for automating receipt and invoice submission

- VAT compliance and submissions

- Technical support on-hand

Most Theta 7 accounting packages already include a certain amount of bookkeeping support.

If you are an existing Theta 7 customer, please talk to your Account Manager about increasing your bookkeeping capacity.

If you have more complex account needs, our Management Accounting Services can help

A management accounting service can vary dramatically to include any number of the following variations:

This registration process aims to ask you a number of questions to get an idea of your bespoke requirements. If you think its easier, just give one of our experts a call!!

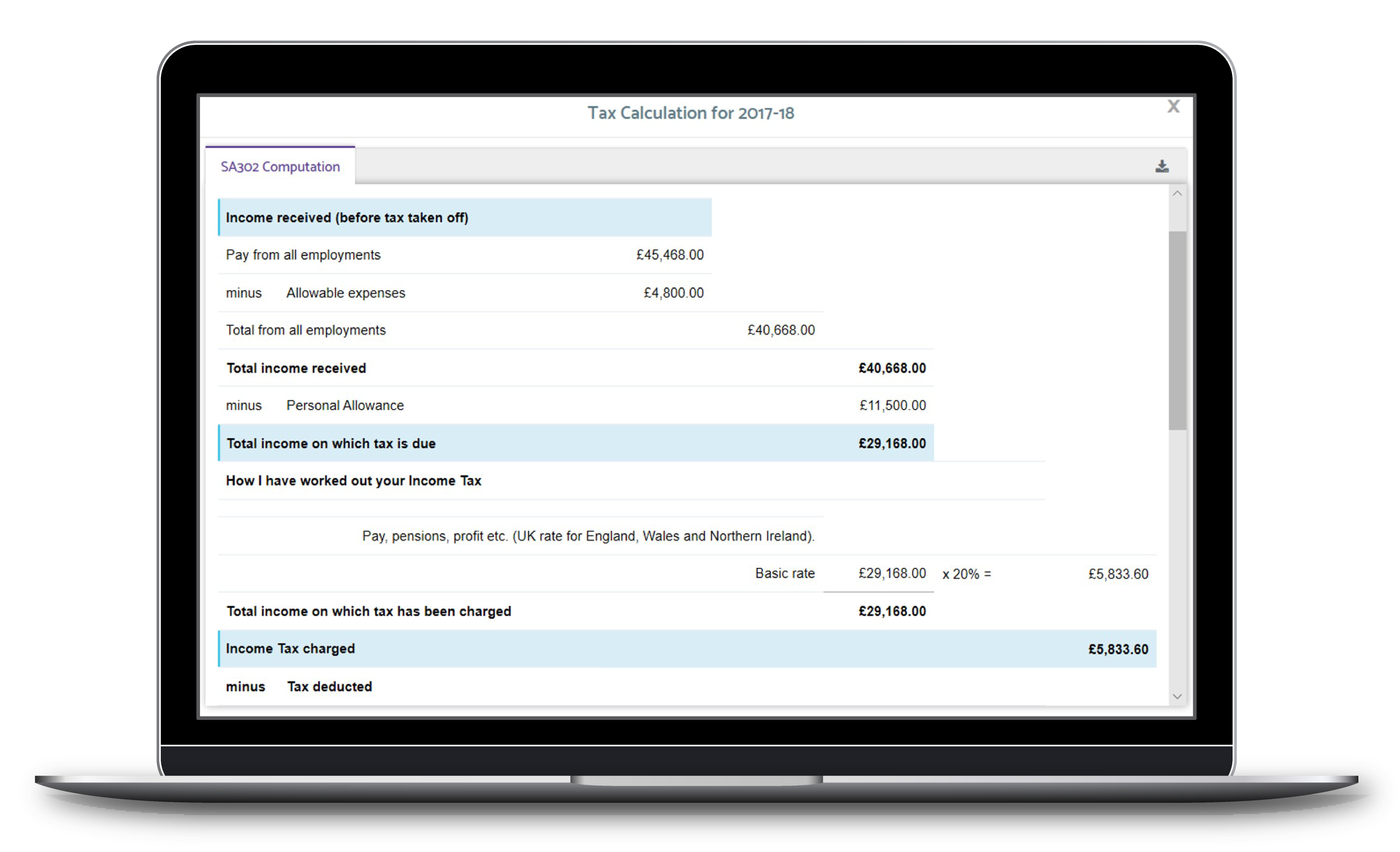

For expats living within the United Arab Emirates or conducting business onshore or via a freezone we can handle your domestic personal tax compliance within your home country.

United Kingdom

As well as the UAE we are fully licenses accountants and tax advisers within the United Kingdom, with offices in the South East of England. This allows us to handle your UAE and UK tax affairs under a single service.

As licensed UK accountants, we can even handle any UK company accounts and corporation tax requirements you may have.

United State of American

Coming soon...

India

Coming soon...

Kenya

Coming soon...

Personal tax advice requires in depth knowledge of your domestic region as well as country specific professional qualifications and licenses. Within this in mind, it is difficult to offer these services to all countries, however, it is likely we may have a partnership with an accounting firm in your home country so feel free to conduct us for more details.

Our accounting and bookkeeping packages include processing, preparation and filing of your VAT Returns to the UAE Federal Tax Authority.

This VAT Agent service focuses on organisations with increased complexity within their accounting processes. This could include overseas aspects, group registration for VAT, multiple accounting systems or consolidated VAT Returns.

Investor, Employee & Dependent Visas from AED 2900